Not known Facts About Which Type Of Bankruptcy Should You File

Not known Facts About Which Type Of Bankruptcy Should You File

Blog Article

The Ultimate Guide To Tulsa Bankruptcy Filing Assistance

Table of ContentsFacts About Experienced Bankruptcy Lawyer Tulsa UncoveredNot known Details About Bankruptcy Lawyer Tulsa Tulsa Bankruptcy Attorney - An OverviewTop Guidelines Of Bankruptcy Lawyer TulsaThe Main Principles Of Experienced Bankruptcy Lawyer Tulsa

The statistics for the various other primary type, Chapter 13, are also worse for pro se filers. Suffice it to state, talk with a legal representative or 2 near you that's experienced with personal bankruptcy regulation.Lots of lawyers also offer free appointments or email Q&A s. Benefit from that. (The charitable application Upsolve can aid you locate cost-free assessments, sources and lawful help absolutely free.) Ask them if personal bankruptcy is indeed the ideal choice for your scenario and whether they think you'll certify. Prior to you pay to submit bankruptcy types and acne your credit history report for up to ten years, check to see if you have any type of practical options like debt arrangement or non-profit credit rating counseling.

Advertisements by Money. We may be made up if you click this advertisement. Ad Now that you have actually chosen personal bankruptcy is indeed the right course of action and you ideally cleared it with a lawyer you'll require to begin on the documentation. Prior to you dive into all the main personal bankruptcy kinds, you need to get your own documents in order.

Tulsa Bankruptcy Attorney - An Overview

Later on down the line, you'll actually need to confirm that by revealing all type of info concerning your financial events. Right here's a standard list of what you'll need when traveling ahead: Identifying records like your chauffeur's permit and Social Protection card Income tax return (as much as the past 4 years) Proof of revenue (pay stubs, W-2s, freelance incomes, earnings from assets in addition to any revenue from government benefits) Bank statements and/or pension statements Evidence of worth of your possessions, such as car and realty assessment.

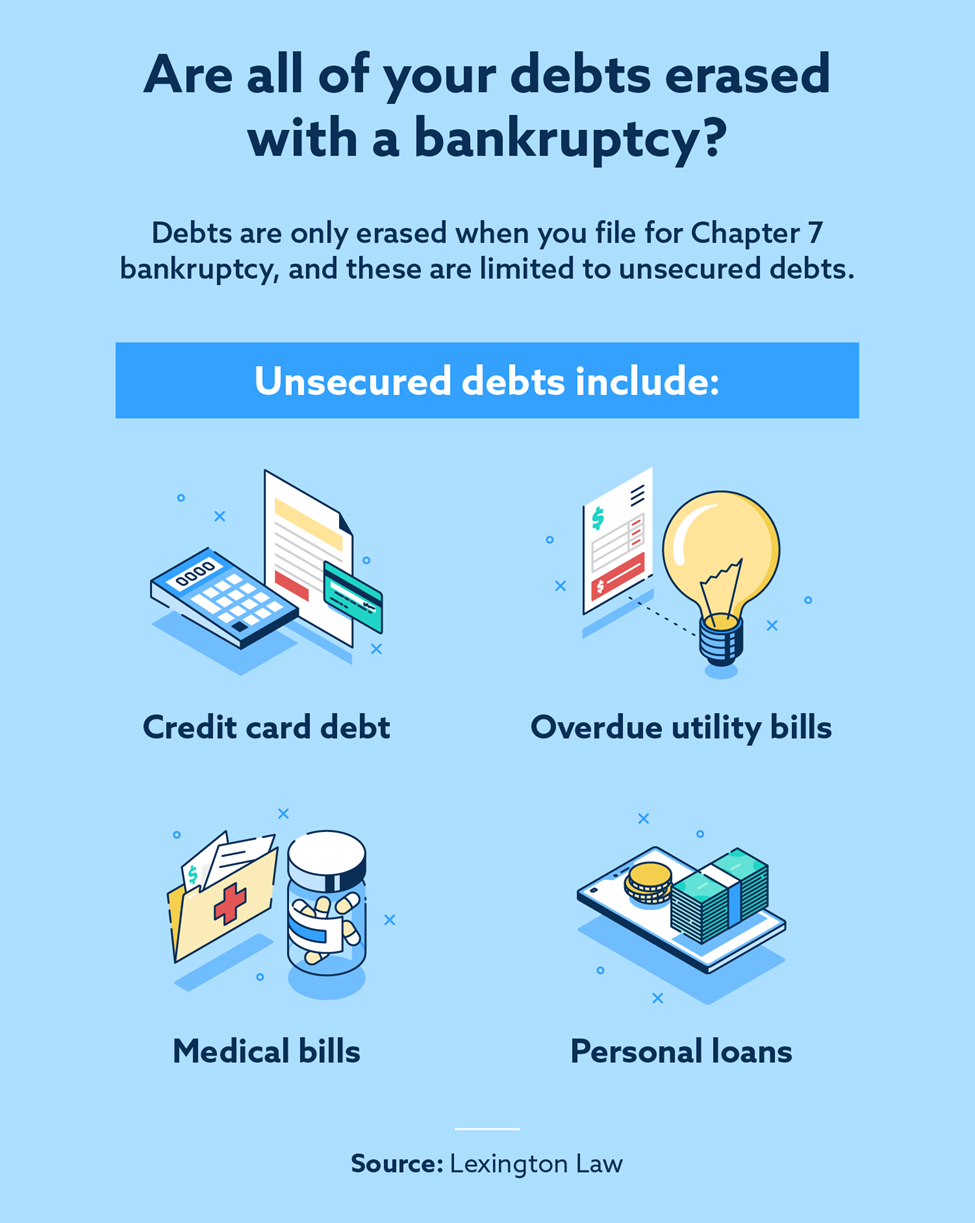

You'll desire to understand what type of financial debt you're trying to settle.

You'll desire to understand what type of financial debt you're trying to settle.If your revenue is too high, you have another option: Phase 13. This alternative takes longer to settle your financial debts due to the fact that it calls for a lasting settlement plan generally three to five years prior to some of your staying financial obligations are cleaned away. The filing procedure is additionally a great deal extra intricate than Phase 7.

Everything about Tulsa Debt Relief Attorney

A Phase 7 personal bankruptcy remains on your credit score record for 10 years, whereas a Chapter 13 bankruptcy falls off after 7. Prior to you submit your personal bankruptcy forms, you should initially complete an obligatory program from a credit score counseling agency that has actually been accepted by the Division of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The training course can be completed online, face to face or over the phone. Training courses generally cost between $15 and $50. You need to finish the course within 180 days of filing for insolvency (bankruptcy lawyer Tulsa). Make use of the Division of Justice's web site to locate a program. If you live in Alabama or North Carolina, you have to choose and complete a course from a listing of independently accepted suppliers in your state.

Top Tulsa Bankruptcy Lawyers - Truths

Inspect that you're filing with the right one based on where you live. If your permanent house has relocated within 180 days of loading, you ought to file in the district where you lived the higher section of that 180-day duration.

Normally, your personal bankruptcy attorney will certainly work with the trustee, however you read this may require to send the person papers such as pay stubs, tax obligation returns, and financial institution account and debt card declarations straight. A typical misunderstanding with bankruptcy is that once you submit, you can quit paying your financial obligations. While bankruptcy can help you wipe out several of your unprotected financial debts, such as past due clinical costs or personal finances, you'll want to keep paying your monthly repayments for secured debts if you want to keep the residential or commercial property.

A Biased View of Affordable Bankruptcy Lawyer Tulsa

If you go to risk of repossession and have exhausted all other financial-relief alternatives, after that declaring Phase 13 might postpone the foreclosure and assist in saving your home. important source Ultimately, you will still require the income to proceed making future mortgage payments, in addition to paying off any type of late payments over the program of your repayment plan.

If so, you might be needed to provide additional details. The audit might delay any type of financial obligation relief by several weeks. Certainly, if the audit transforms up inaccurate information, your instance could be disregarded. All that stated, these are relatively unusual circumstances. That you made it this much at the same time is a respectable indication at the very least several of your financial debts are qualified for discharge.

Report this page